Market Facts

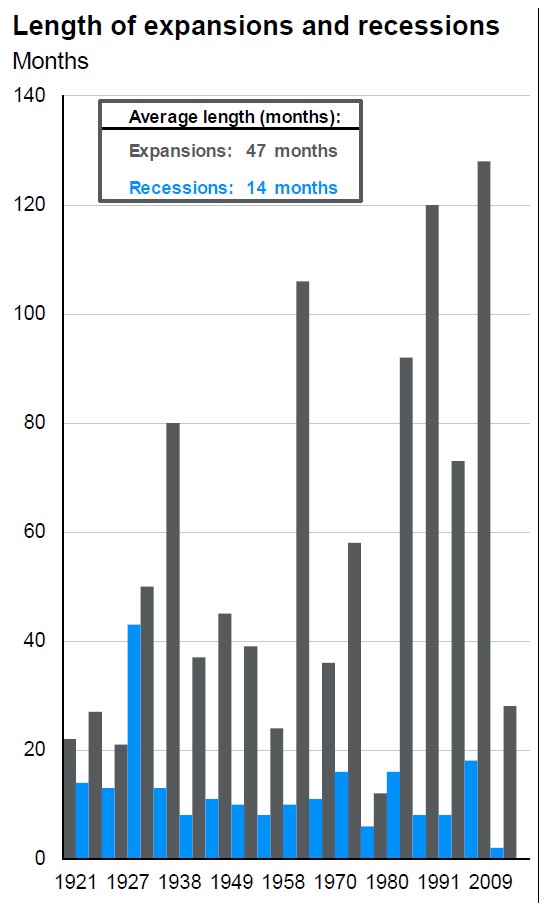

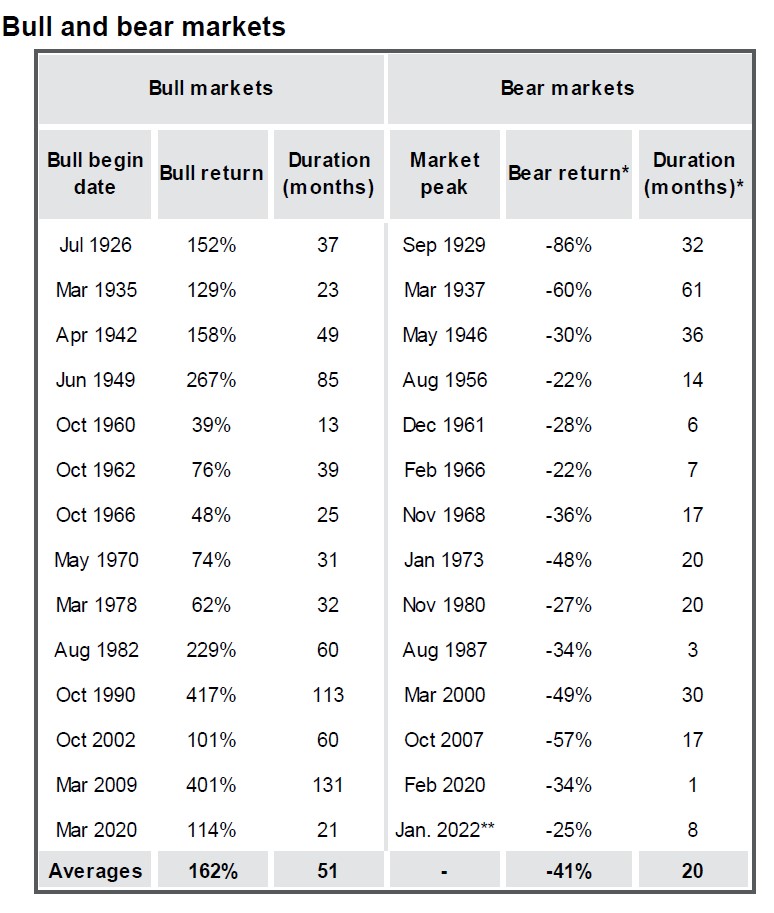

TIME IN THE STOCK MARKET – If you selected any single month at random to invest in the S&P 500 during the 30-years ending 6/30/2022, you achieved a positive total return 67% of the time. If you extend your investment time horizon to just 1 year, you achieved a positive total return 83% of the time. If your time horizon was 5 years, you achieved a positive total return 84% of the time (source: BTN Research).

TOP SPOT – China and India are 1 and 2 in terms of population today, a ranking that is projected to flip-flop next year (2023) when India becomes the world’s most populous nation with nearly 1.5 billion people (source: UN).

WORKERS NEEDED – The Social Security Administration estimates it needs a “worker-to-beneficiary” ratio of 2.8 for the system to function on a “pay-as-you-go” basis. The ratio was 3.3 in 2005 but has slipped to 2.8 in 2021 and is forecasted to be just 2.1 workers per beneficiary by the year 2040 (source: Social Security).

JUMBO COLA – The Social Security Administration just announced an 8.7% cost of living adjustment for retirees, the largest adjustment in 40 years, benefiting over 70 million Americans (source: New York Times).

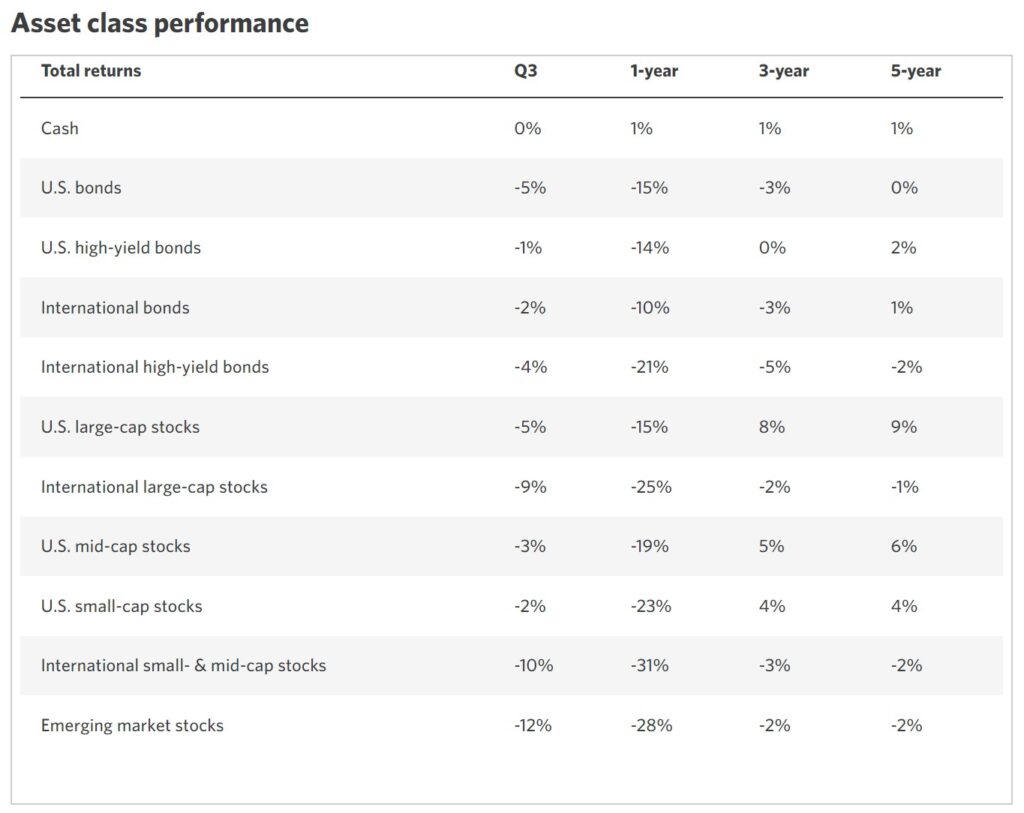

Market Indices

Quarterly Recap

Economy – The U.S. economy continued to slow amid the backdrop of persistent 40 year high inflation pressures, as well as an ultra aggressive Fed monetary policy tightening campaign which delivered a 75 basis point (bp) rate hike for a third straight meeting. Financial conditions continued to tighten in the form of higher borrowing costs, which is beginning to stymie demand, notably in the housing market. Meanwhile, China’s continued COVID induced lockdowns, a strong U.S. dollar, and myriad headwinds in Europe dampened global economic activity. However, the labor market continued to grow, although it’s important to note that the employment situation is not a leading economic indicator. Consumer spending was mixed as inflation continued to impact spending decisions, although the shift to services and away from goods consumption, appeared to endure.

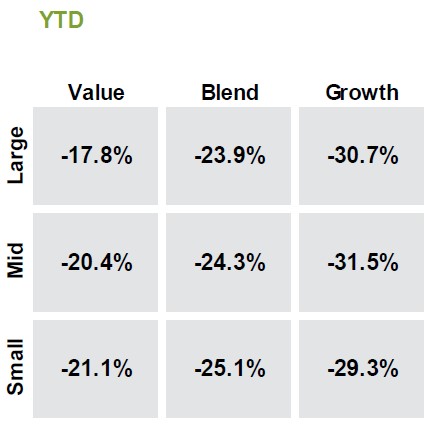

Equities – U.S. stocks bounced off the June 16 lows, showing some resiliency in the face of the impact on the currency and interest rate markets of the aggressive Fed actions, inflation’s tenacity, and multiple headwinds globally. A tight labor market, the pullback in commodity prices, signs of improving supply chain conditions, and a better than feared Q2 earnings season likely helped U.S. equity outperformance. International stocks were hampered by increased recession concerns in Europe, the rallying U.S. dollar, and China’s slowdown, all of which came as most major central banks across the globe tightened monetary policies.

Income – The Fed continued to aggressively tighten monetary policy in the third quarter and signaled that it will continue to tighten monetary policy to combat high inflation. Short term Treasury yields rose more than longer term yields which resulted in an inverted yield curve. Corporate credit spreads rose during the quarter but were off their peaks in early July. Municipal yields rose, albeit less so than Treasuries, which richened valuations modestly. The dollar continued to move higher weighing on total returns for global and emerging market fixed income investments. Although most central banks are raising rates, the Federal Reserve is expected to tighten policy more aggressively than many other developed market central banks.

Commodities – Given the increasing global recession concerns due to the issues in Europe and China, as well as tightening global monetary policies together with the strength in the U.S. dollar it’s not surprising that commodity prices pulled back. However, natural gas prices continued to rally and remain a significant source of concern from an inflation standpoint with Europe a key focus, as Russia has cut off energy supplies to the region as a result of the sanctions imposed by the West, in response to Russia’s invasion of Ukraine.

Do You Want to Be One of the First to Receive Quarterly Updates?