Summary

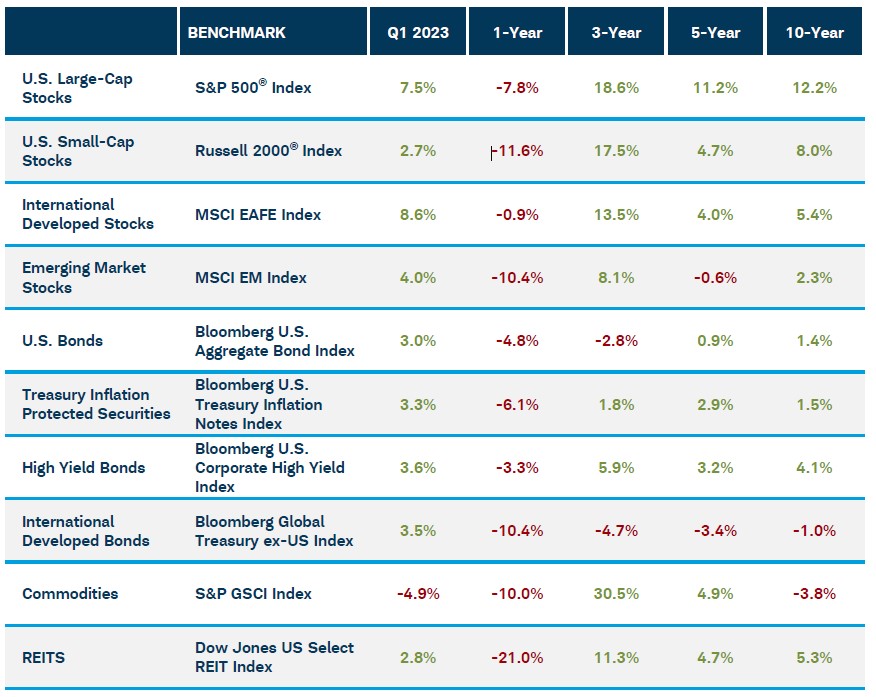

Similar to the fourth quarter of 2022, U.S. stocks, as represented by the S&P 500 Index, advanced by 7.5% in the first quarter of 2023. Growth-heavy sectors like Tech and Communication Services outperformed, as investors flocked to large-cap names in the face of the unfolding banking crisis.

U.S. bond yields, as represented by the Bloomberg U.S. Aggregate Bond Index and move inversely from bond prices, fell sharply largely as a result of turmoil in the banking sector and expectations that the Fed would need to cut rates aggressively later this year. International bonds posted positive returns; this was in line with other highly rated fixed income sectors.

Commodities pulled back, led by a tumble in natural gas and a solid fall in crude oil, while REITS dropped due to the choppiness in interest rates and concerns in the banking sector.

Market Indices

Quarterly Recap

Economy – Parts of the U.S. economy began to reaccelerate in the first quarter. Notably, payroll growth has remained resilient, the unemployment rate continues to hover near historic lows, and services sector hiring remains robust (which has helped maintain upward pressure on wage growth and services inflation). The slower pace of disinflation has become an issue for the Federal Reserve, which must now balance a brewing financial stability issue (courtesy of stress in the banking system) with still-hot inflation and an increasingly tight labor market. To be sure, as Fed officials have noted, the fallout from Silicon Valley Bank and other banks will likely accelerate the tightening in credit conditions; however, it remains to be seen as to how much a tighter credit market will slow economic activity and inflation.

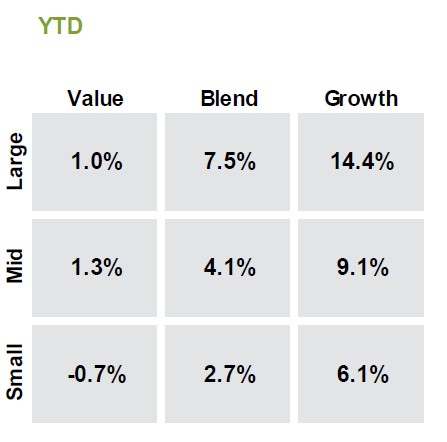

Equities – Strong performance within the U.S. stock market has been concentrated in the areas that were hit hardest in 2022. Most of the leadership to date in 2023 has been characterized as a mean reversion trade, meaning stocks that underperformed the most last year have outperformed the most this year, as growth-oriented (and even some speculative) segments of the market rebounded sharply and led stocks higher. Stronger economic data dampened an equity rally starting in February, cementing a theme that has been in place for most of this bear market: signs of a strong economy—and hence hotter inflation—will likely force the Fed to be more aggressive in setting monetary policy. With the stress in the banking system now, however, stocks are facing an increasingly uncertain path due to tighter credit conditions.

Income – Despite turmoil in the banking sector, the Federal Reserve raised rates again for the ninth straight time and signaled that additional policy tightening may be warranted. Yields for high credit quality bonds fell sharply as investors sought perceived safe havens. Short-term Treasury yields fell as the market began to price in the possibility of rate cuts later this year, despite the Fed indicating that rate cuts were not in their base case. The yield curve inversion lessened, but ended the quarter still inverted. Credit spreads rose due to concerns that the banking turmoil may be widespread. Municipal bond yields also fell, but less so than Treasuries of similar maturity.

Commodities – Natural gas plunged and crude oil prices dropped as the U.S. dollar stabilized amid uncertainty regarding the impact of global monetary policy tightening on economic growth, and warmer winter weather in Europe. Metals prices were mixed as gold rallied on some flight to safety, although nickel prices tumbled, while agriculture prices also diverged. The choppiness in commodities also came courtesy of global uncertainties, exacerbated geopolitical tensions, and China’s sooner-than-anticipated reopening.