Summary

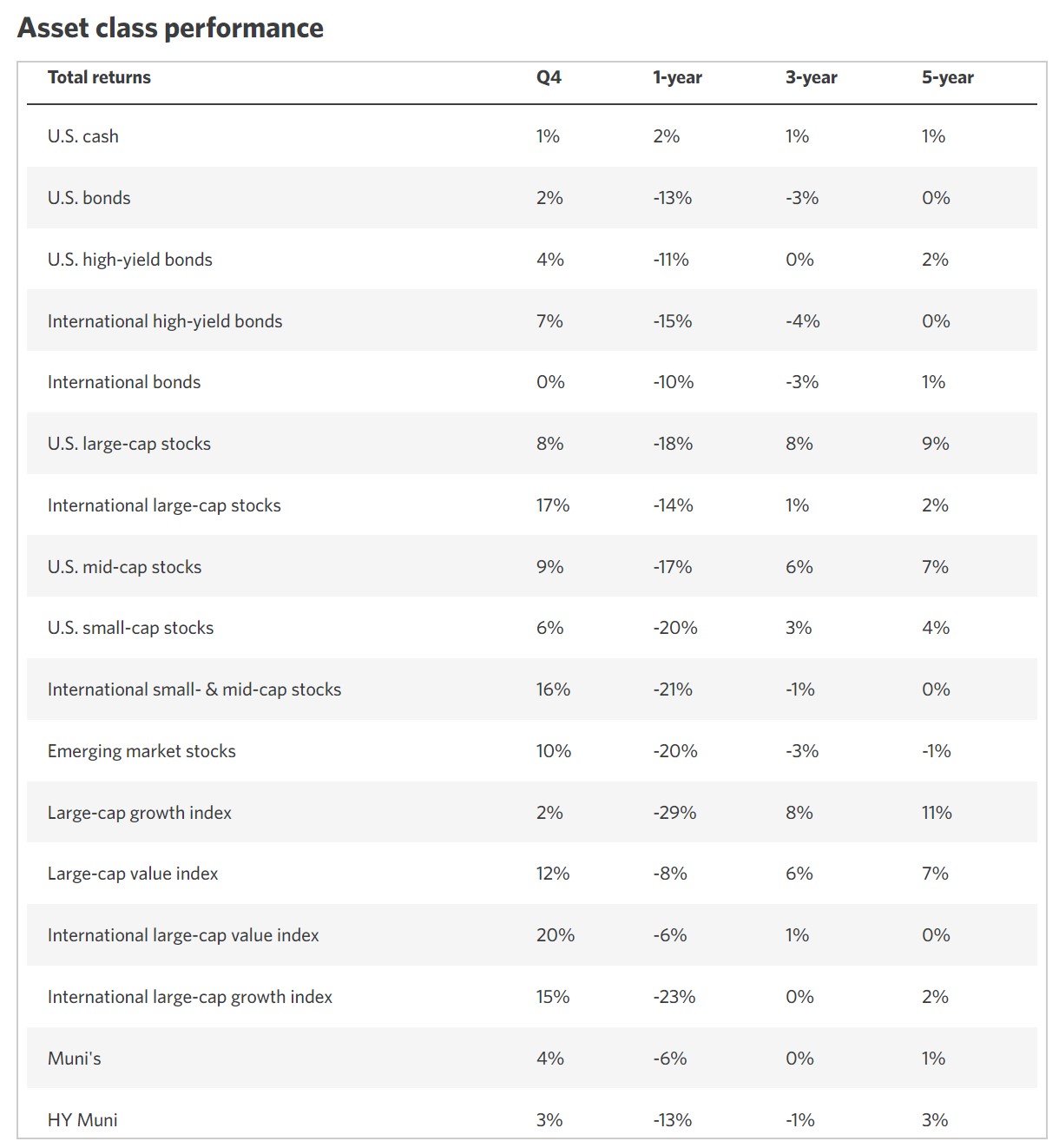

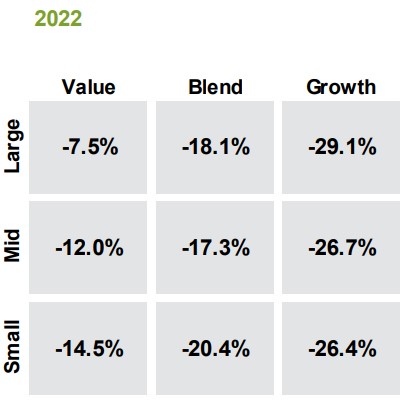

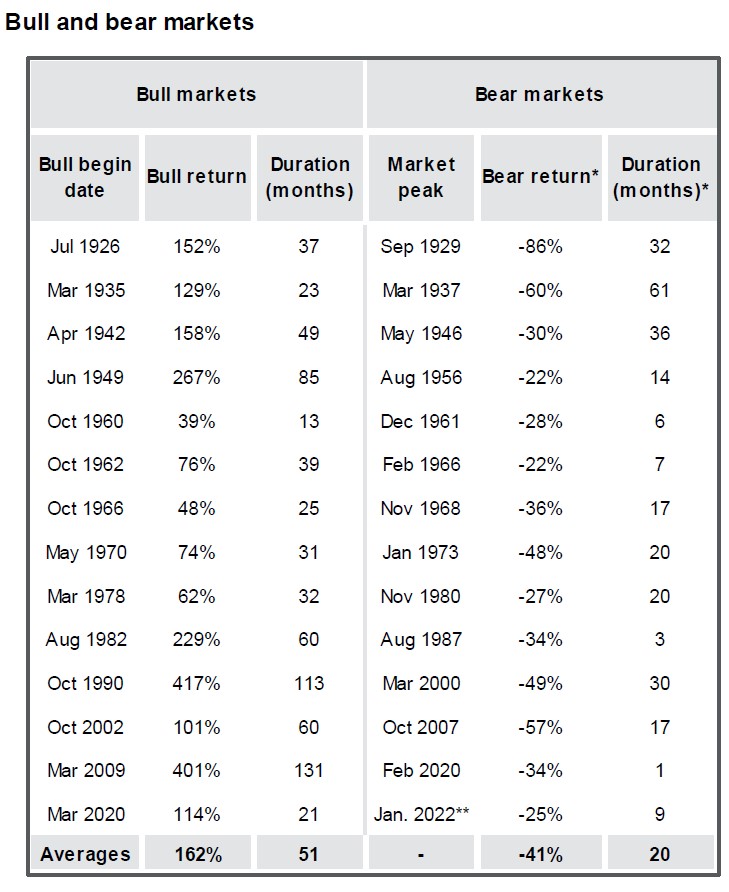

After three consecutive quarterly declines, U.S. stocks moved higher in Q4 but underperformed their international peers. Investors favored value- and cyclical-oriented segments of the market, which outperformed their growth peers by a considerable margin. U.S. bond yields, as represented by the Bloomberg U.S. Aggregate Bond Index, appear to have peaked as we approach the end of the Fed’s rate hike cycle, and the markets began to price in potential rate cuts down the road.

Market Indices

Quarterly Recap

Economy – Parts of the U.S. economy, notably, the services sector, maintained some relative strength while others, such as the goods sector, continued to weaken—all in the face of inflation that is now decisively easing. Leading economic indicators (LEI) continued to deteriorate and are giving virtually every potential recession signal. The LEI’s year-over-year decline, the contraction in the ISM Manufacturing PMI, and both consumer and business confidence are signaling a more significant slowdown ahead. This shouldn’t come as a surprise given the Fed’s aggressive rate hike campaign, which is still in effect today—despite a step down from a series of 75 basis point rate increases.

Equities – U.S. stocks moved up from their October 12 lows but gave much of the November rally back. Investors’ fears are likely shifting focus away from inflation and increasingly towards the broader economy, and specifically the labor market. As it became clear that the peak in inflation is behind us, and that the Fed’s policies are working to reduce demand, the market has started to scrutinize inflation data to a lesser degree. Any sustained increases in income growth may force the Fed to remain aggressive, which would likely exert additional downward pressure on stocks in the near term.

Income – The Federal Reserve continued to aggressively tighten monetary policy in the fourth quarter but stepped down the size of its rate hikes in December. Short-term Treasury yields rose sharply, while intermediate- and long-term Treasury yields ended the quarter relatively flat as the markets began to price in potential rate cuts down the road. As a result, the yield curve continued to invert. Credit spreads shrugged off growth concerns and fell, however, while municipal bond yields also fell. The dollar declined, likely due to shrinking interest rate differentials as we approach the end of the Fed’s rate hike cycle. The drop in the dollar helped international bonds perform well in the fourth quarter.

Commodities – The commodity complex was mixed as the markets grappled with a decline in the U.S. dollar, China’s evolving COVID restriction policy, the ongoing war in Ukraine, and global recession concerns, accelerated by aggressive monetary policy tightening around the globe. Energy prices were choppy and agriculture prices were mixed, while metals prices posted solid broad-based gains.