Summary

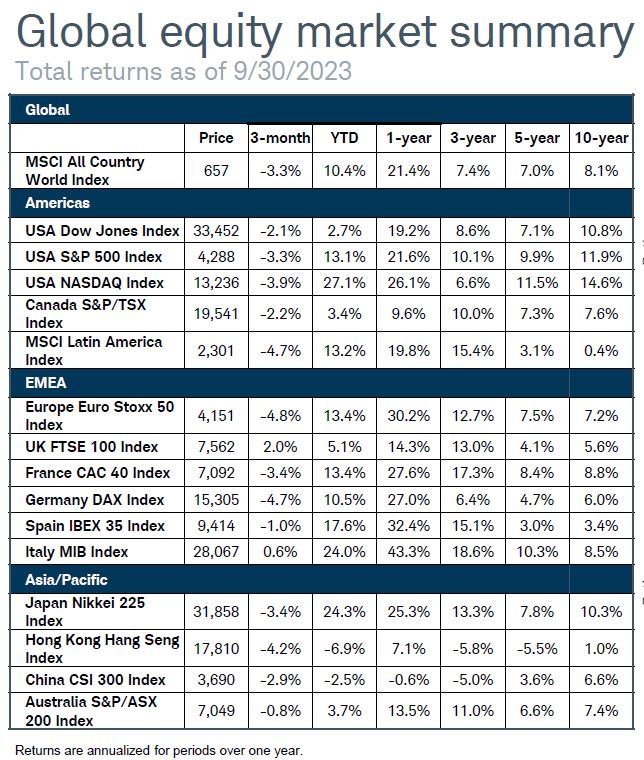

Equities struggled as second quarter earnings results were met with a lack of enthusiasm. While companies outpaced profit expectations, revenue growth was almost flat; and on an inflation inflation-adjusted basis, revenues continued to fall. The trifecta of an increase in the dollar, oil prices, and yields put downward pressure on stocks later in the quarter.

U.S. bond yields, as represented by the Bloomberg U.S. Aggregate Bond Index continued to rise in the third quarter resulting in a negative return for the quarter. The Fed hiked rates again and signaled that there may be an additional rate increase this year.

Global central banks continued to raise rates in the third quarter resulting in higher yields, and lower prices, on many international bonds. Returns were negative for the second straight quarter.

Crude oil’s rally bolstered commodity indexes despite a strong U.S. dollar, lingering lethargy in China’s economy economy— which likely weighed on industrial metals—and record high U.S. oil production. REITS gave up Q2’s gains amid the backdrop of the uncertain economic landscape landscape—notably rising interest rates.

U.S. bond yields (moving inversely from bond prices) rose in the second quarter as banking sector concerns subsided and market expectations for the peak fed funds rate increased.

Despite a bounce in natural gas, commodities continued to fall, led by metals and crude oil, as a result of demand concerns regarding the U.S. and China and increasing supply in the energy space. REITS were choppy on dynamic Fed/Market interest rate expectations.

Quarterly Recap

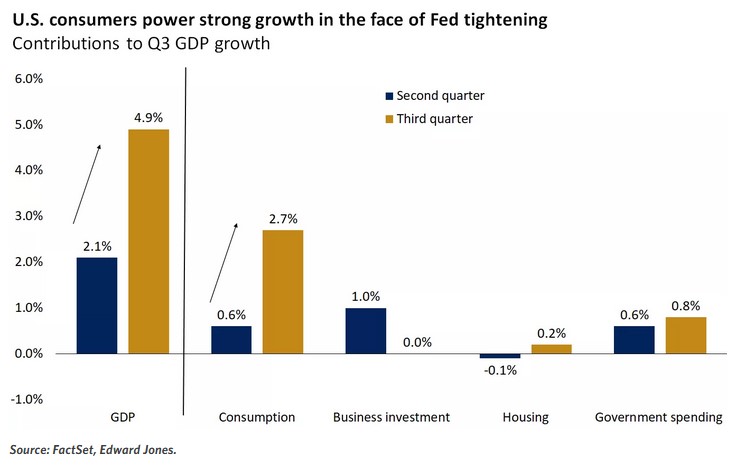

Economy – Key segments of the economy—like homebuilder sentiment sentiment—that started to hint at a recovery earlier this year began to falter in the third quarter. Housing has been under pressure given the toxic mix of higher mortgage rates, low inventory, and stubbornly high home prices, however the lack of recovery in homebuilder sentiment would not bode well for the broader economy. The labor market continues to look tight, but some measures of labor force participation remained relatively elevated, underscoring the fact that individuals continue to re-enter the workforce. Although this is encouraging down the line for wage inflation, wage growth is likely still too fast for the Fed’s comfort.

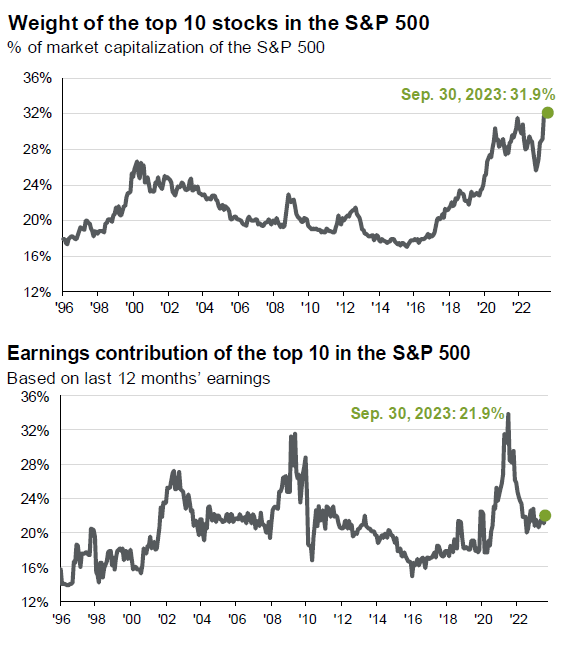

Equities – U.S. stocks came under pressure throughout the quarter. Despite a continued high earnings beat rate, second-quarter earnings season was not as great as some believed. Revenue growth was largely flat and real revenues contracted for the third consecutive quarter. Companies that beat earnings estimates did not see their stock prices rewarded, which means investors likely shifted focus to the fact that demand has continued to wane (and that earnings strength has come via aggressive cost cutting). Towards the end of the quarter, a combination of rising bond yields and oil prices kept fears of elevated inflation alive, which in turn helped maintain downward pressure on stocks.

Income – U.S. Treasury yields climbed higher in the third quarter as the Federal Reserve continued to raise its benchmark interest rate. After hiking in July and holding rates steady in September, projections from the Federal Reserve left the door open for one more rate hike this year. Market expectations suggest a roughly 50% chance of an additional rate hike according to the fed funds futures market. Regardless of whether the Fed raises rates again, you should expect the benchmark rate to remain elevated through at least Q1 2024, which should keep the yield curve inverted for the near-term.

Commodities – The story in the commodity complex was the sharp rally in crude oil prices with declining global supply, exacerbated by Saudi Arabia’s extended oil production cuts being met with resilient global demand. Commodity indexes rose even as the U.S. dollar rallied, U.S. oil prod product ion continued to climb, and industrial metals metals—noticeably copper copper—remained constrained by economic uncertainty regarding the ultimate impact of aggressive central bank tightening. Oil prices rose despite services sector activity continuing to outpace manufacturing output. However, iron ore prices—a strong indicator of steel demand demand—posted a solid quarter and is worth watching in Q4.